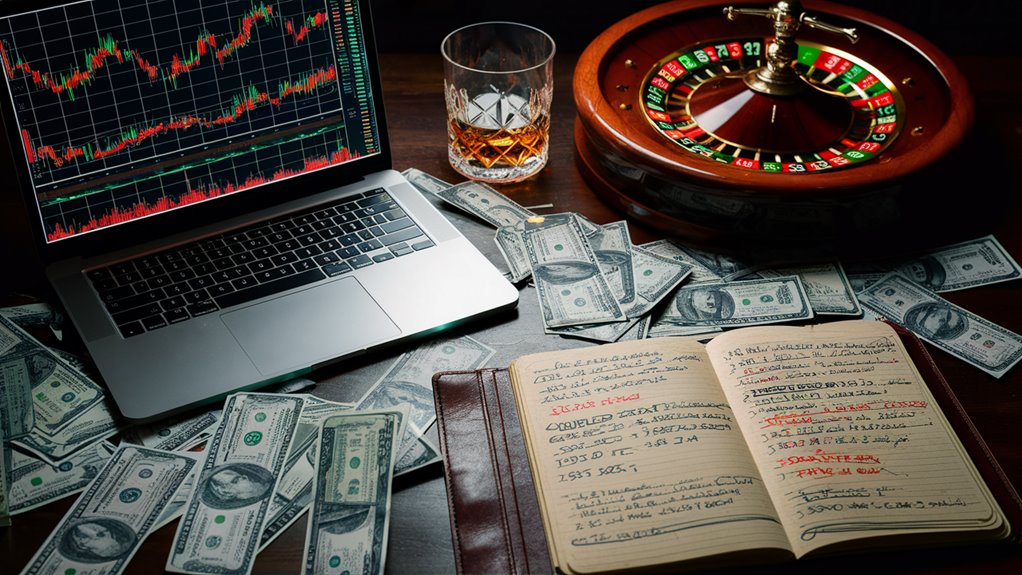

How to Bet on the Stock Market with Gambling Plans

Using Stats to Trade

Using gambling plans in stock trading needs smart math ideas. The best ways are the Kelly Criterion and the Martingale systems changed a bit, turning 온카스터디 공식파트너 확인 sudden market shifts into smart trade moves.

Key Steps to Control Risk

Good trading asks for careful bet sizes and risk check. Use stop losses of 1-2% per trade to keep money safe. Handling portfolios must look at many kinds while keeping strict limits based on how fast things change.

Using Kelly Criterion in Trades

The Kelly rule finds the best bet sizes by looking at:

- Past win chances

- Risk and reward rates

- How much change you can take

- Biggest drop rules

Smart Bet Changes

A changed Martingale plan lets traders:

- Change bets in order

- Grow bets on winning trades

- Small bets in losses

- Grow wins when able

Making Better Trade Decisions

Keep clear trade info like:

- Win/loss rates

- Returns adjusted for risk

- How well your bet sizing works

- How your plans work together

Changing with the Market

Make trade plans that:

- Change with market swings

- Fit current market scenes

- Find the best times to enter or exit

- Rightly size your bets

These math ways change unsure trading into a set plan to make money with a stats lead.

Understanding Chance in Market Moves

Base of Stat Trading

Market chance trends are key to good trade plans. Are Online Casinos Rigged, Breaking the Myths

Studying charts uses stat chances not just feelings or guesswork.

Price moves often show set trends, though market end results are not sure.

Main Chance Marks

Standard diffs show usual price move spans from average levels.